Reservation Fee

This ensures that the home you’ve been eyeing is taken off the market and reserved under your name. Reservation fees vary depending on the value of the property, and may sometimes be deducted from your down payment total. Some developers and sellers may set reservation fees ranging from Php 5,000 to Php 25,000 or higher.

Documentary Stamps Tax

Tax on papers, documents, and agreements that prove the acceptance, sale, and transfer of property ownership from the seller’s name to yours. The DST is 1.5% of either your home’s selling price, fair market value, or zonal value, whichever is higher.

Transfer Tax

Even when you’re buying a brand-new home, you still need to pay this tax to transfer home ownership to your name. Transfer tax varies depending on your location, and may range from 0.5% to 0.75% of the property’s price, fair market value, or zonal value (whichever is higher).

Keep in mind that this tax is paid to the Local Treasurer’s Office. You only owe transfer tax to the Bureau of Internal Revenue (BIR) if the property was donated to you.

Notary Fee

To guarantee the authenticity of your transaction, the Deed of Absolute Sale should be notarized. Fees range from 1% to 1.5% of your chosen home’s price.

Title Registration Fee

When this fee is due, you know that you are only a few days away from owning your first home. The title registration fee is paid to officially list the property’s title under your name. This is usually set at 0.25% of the selling price, fair market value, or zonal value of your home, whichever is higher.

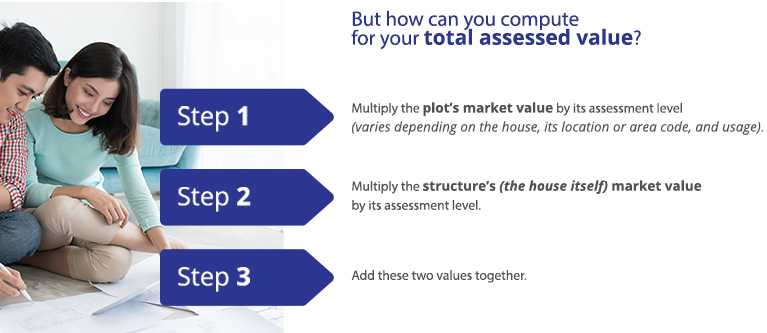

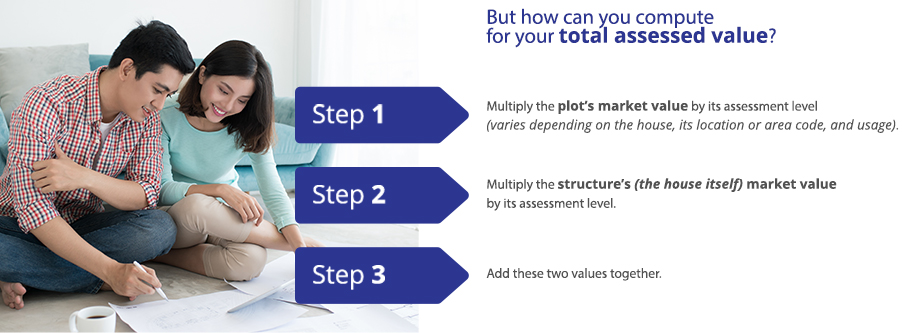

Real Property Tax

You might know this tax as amilyar, a fee paid to your Local Government Unit each year. In Metro Manila, the regular rate is 2% of your home’s total assessed value (also referred to as taxable value). 1% is taxed for properties in provinces.