Financial Red Flags:

Signs You Shouldn’t Ignore in Relationships

Money is one of the most powerful forces in any relationship, whether it’s between partners, family members, or business collaborators. When handled openly and responsibly, finances can strengthen trust. When mishandled, they can quietly erode it.

Financial red flags, when ignored, often lead to long-term stress, conflict, and regret. Recognizing these warning signs early can make all the difference.

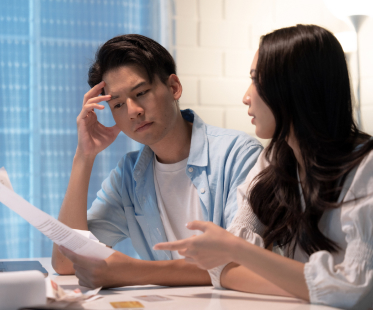

Lack of transparency around money

One major red flag is secrecy around money. If someone avoids conversations about income, debts, spending habits, or financial goals, it may signal deeper issues.

Transparency doesn’t mean sharing every receipt, but consistent avoidance or defensiveness when money comes up can point to hidden debt, poor habits, or a lack of trust. Healthy financial relationships are built on openness.

Irresponsible or unchecked spending habits

Another warning sign is a pattern of irresponsible spending. Everyone makes occasional impulse purchases, but chronic overspending, living beyond one’s means, or relying heavily on credit without a plan to repay it can create serious strain.

This becomes especially concerning when one person’s habits directly impact shared finances or future plans, such as savings, housing, or retirement.

Imbalanced financial control

Unequal control over finances is another red flag that’s often overlooked. When one person insists on managing all the money, restricts access to accounts, or makes major financial decisions unilaterally, it can create an unhealthy power imbalance.

Financial control can be subtle, but it undermines partnership and mutual respect. Both parties should have a clear understanding of their financial situation and a voice in decisions.

Recurring financial emergencies

Be cautious of frequent financial crises. Constant emergencies, whether it’s needing loans, missing payments, or last-minute requests for help, may indicate poor planning or deeper financial instability.

While supporting someone during a genuine hardship is part of any relationship, repeated patterns can signal that the issue is ongoing and unresolved.

Conflicting financial values and goals

Another important red flag is misaligned financial values and goals. Differences aren’t inherently bad, but if one person prioritizes saving and long-term security while the other focuses solely on short-term spending, conflict is likely.

Without honest conversations and compromise, these differences can widen over time and lead to resentment.

How you can start with shared financial goals

HC Mutual is here to support your saving journey, no matter where you’re starting from. Our programs are designed to help growing families and first-time savers build strong, sustainable saving habits.

Whether your goal is to create an emergency fund, save for your first home, or feel more confident handling unexpected expenses, we focus on helping you make steady progress.

If you’re ready to prioritize saving this year, our savings plans, with built-in loan benefits, offer a practical and manageable way to stay protected while growing your funds.

Secure your future through saving.

- Start saving for as low as PHP 101 per payday.

- Flexible savings plan of 3, 5, or 7 years.

- 3% earnings from your savings per annum.

Earn more from your savings to reach your goals faster.

- Start saving for as low as PHP 1,212, PHP 2,424, or PHP 3,636 per payday.

- Fixed 5-year savings plan.

- 5% per annum after 5 years upon completion of the plan.

Be prepared for any occasion.

Be prepared for financial emergencies.

- Loan release within 24 hours of approval

- Interest rate as low as 0.99%*

- Flexible payment terms of 12, 18, or 24 months

Rebuilding your savings after the holidays doesn’t require drastic changes; just steady, intentional steps. With a clear plan and small daily habits, you can turn the new year into a fresh financial start and set the tone for a stronger 2026.

Broken promises and eroded trust

Finally, watch for broken financial promises. This could include failing to repay loans, ignoring agreed-upon budgets, or repeatedly saying “things will change” without action.

Trust is built through consistency, and repeated financial letdowns can damage both emotional and financial security.

Protecting your financial future

At HC Mutual, we believe financial well-being is deeply connected to healthy relationships. Paying attention to these red flags isn’t about assigning blame. It’s about protecting your future.

Addressing concerns early, seeking guidance, and having honest conversations can help turn potential problems into opportunities for growth. When it comes to money and relationships, awareness is your strongest asset.

SHARE