For First-time Home Buyers: Property Fees and Taxes

June 15, 2020 | by HC Mutual

Saving up for your first home? As you plan your budget, keep in mind that there are fees that have to be settled before and after closing the deal. To help you prepare for this major milestone in life, we’ve made a list of the added costs and common taxes when buying property.

Reservation Fee

This ensures that the home you’ve been eyeing is taken off the market and reserved under your name. Reservation fees vary depending on the value of the property, and may sometimes be deducted from your down payment total. Some developers and sellers may set reservation fees ranging from Php 5,000 to Php 25,000 or higher.

Documentary Stamps Tax

Tax on papers, documents, and agreements that prove the acceptance, sale, and transfer of property ownership from the seller’s name to yours. The DST is 1.5% of either your home’s selling price, fair market value, or zonal value, whichever is higher.

Transfer Tax

Even when you’re buying a brand-new home, you still need to pay this tax to transfer home ownership to your name. Transfer tax varies depending on your location, and may range from 0.5% to 0.75% of the property’s price, fair market value, or zonal value (whichever is higher).

Keep in mind that this tax is paid to the Local Treasurer’s Office. You only owe transfer tax to the Bureau of Internal Revenue (BIR) if the property was donated to you.

Notary Fee

To guarantee the authenticity of your transaction, the Deed of Absolute Sale should be notarized. Fees range from 1% to 1.5% of your chosen home’s price.

Title Registration Fee

When this fee is due, you know that you are only a few days away from owning your first home. The title registration fee is paid to officially list the property’s title under your name. This is usually set at 0.25% of the selling price, fair market value, or zonal value of your home, whichever is higher.

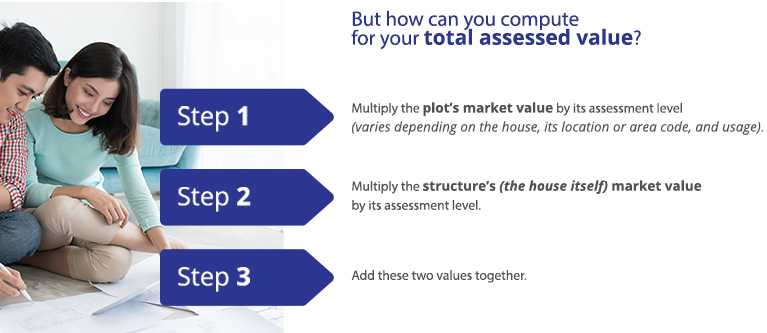

Real Property Tax

You might know this tax as amilyar, a fee paid to your Local Government Unit each year. In Metro Manila, the regular rate is 2% of your home’s total assessed value (also referred to as taxable value). 1% is taxed for properties in provinces.

Home and Life Insurance

Insurance companies, banks, and financial institutions provide different packages. Before choosing one, get to know the full details of what they are offering you. Most lenders carry fire insurance; however, it’s best to opt for more comprehensive coverage. Consider getting fire and water insurance to include acts of god, vandalism, and more. Investing in extra protection can get you and your family through unexpected moments and give you peace of mind.

Some entities also offer discounted fees for life insurance, while others include them as a loan benefit. For instance, the HC Mutual KayaMo Home Loan covers 1-year Accidental-Life Insurance worth Php 500,000.

The list of fees and taxes may seem overwhelming, but it pays to be an informed home buyer. By understanding what you need to factor into your budget, you can decide on a home that perfectly fits your goals and financial capacity.

Note: Fees and taxes vary depending on your property and financing program.

Article sources: Lamudi, My Property PH, Bureau of Internal Revenue

SHARE

Related Posts

Understanding Financial Literacy

From “I do” to “We’re expecting”:

Save Money for Sudden Expenses